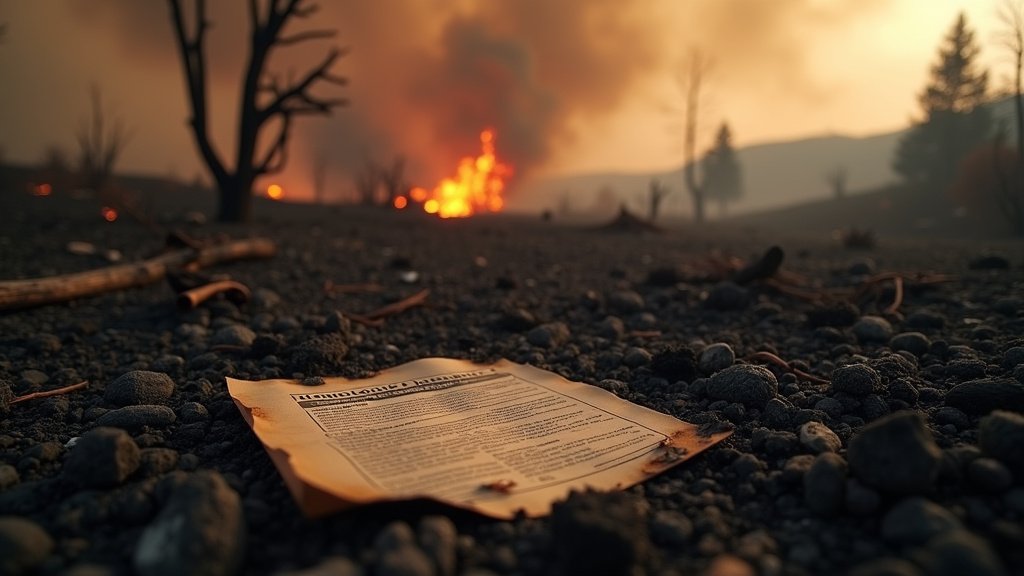

In 2025, California faced unprecedented challenges, particularly concerning California Wildfires Insurance. A severe homeowners insurance crisis gripped residents amidst widespread wildfire destruction, dominating headlines and impacting thousands. Historic wildfires struck Los Angeles early in the year, with the Eaton and Palisades fires proving particularly devastating. These blazes alone caused significant destruction, with the Eaton Fire claiming 19 lives and the Palisades Fire causing at least 12 deaths. In total, the January wildfires killed 31 people, destroyed over 16,000 homes and buildings, and forced over 180,000 residents to evacuate.

The Scale of the Disaster and California Wildfires Insurance Implications

The January fires were fueled by a perfect storm: extreme Santa Ana winds gusting up to 100 mph and drought conditions creating dry vegetation, allowing fires to spread with alarming speed. The Palisades Fire destroyed over 6,800 structures, while the Eaton Fire burned over 14,000 acres and destroyed approximately 9,400 structures. The cumulative wildfire destruction across over 57,529 acres resulted in staggering economic losses. Swiss Re reported $40 billion in insured losses from these fires, making it the costliest wildfire event globally, with some estimates placing total economic losses as high as $57 billion, further straining the availability of California Wildfires Insurance.

The Insurance Market Unravels Amidst the California Wildfires Insurance Crisis

The wildfire crisis intensified California’s ongoing insurance crisis. Many insurers significantly reduced their presence in the state, stopping new homeowners policies and canceling or not renewing existing ones. This left many homeowners scrambling for coverage, driving premiums up by 20-60% annually. Finding essential homeowners insurance became incredibly difficult, even for those residing far from known fire zones, highlighting the severe impact on California Wildfires Insurance availability.

Regulatory Response, the FAIR Plan, and California Wildfires Insurance

In response to the escalating California Wildfires Insurance crisis, the California Department of Insurance took action. Commissioner Ricardo Lara aimed to stabilize the market through new laws designed to encourage insurers to remain in and underwrite coverage in riskier areas. Insurers agreed to consider returning, with a key focus on the FAIR Plan, California’s insurer of last resort for properties deemed too risky for private coverage. The FAIR Plan faced immense claim pressure, requesting a $1 billion assessment from member insurance companies to pay claims from the LA wildfires. Insurers were allowed to pass half this cost to policyholders, demonstrating the extensive financial strain on California Wildfires Insurance providers.

Legal Battles and Accountability Related to California Wildfires Insurance

The devastation sparked numerous lawsuits, many targeting Southern California Edison (SCE), with evidence suggesting their equipment ignited the Eaton Fire. Lawsuits alleged negligence, citing failure to de-energize lines during high winds and poor equipment maintenance. The county of Los Angeles sued SCE for costs and damages. Investigations into faulty evacuation alerts also surfaced, as residents received erroneous warnings, causing confusion and panic. An outside review pointed to systemic weaknesses in how these events were managed, impacting the broader landscape of California Wildfires Insurance claims.

Long-Term Implications for Climate Change Impact and California Wildfires Insurance

The year’s events underscored climate change impact, with warmer temperatures and drought conditions fueling increasingly frequent extreme fire seasons. The insurance crisis persisted, challenging homeowners’ ability to secure affordable homeowners insurance. The cost to rebuild remained high, shaping current trends and highlighting the urgent need for future preparedness and resilience. Addressing climate risks directly is now paramount, influencing the future of California Wildfires Insurance and the state’s overall approach to wildfire risk management.