Lam Research reported outstanding financial results. The company is a leading supplier of wafer fabrication equipment. It announced its second-quarter performance for fiscal year 2026. These results surpassed analyst expectations. Therefore, the news signals robust health in the semiconductor industry. This industry is crucial for cutting-edge technology.

Q2 FY2026 Performance

Revenue for the quarter hit $5.34 billion. This represents a significant 22% increase year-over-year. Lam Research beat revenue estimates. Analysts had predicted around $5.21 billion to $5.33 billion. Non-GAAP earnings per share reached $1.27. This figure exceeded the consensus estimate of $1.16 to $1.19. Consequently, investor confidence remained high.

This marks Lam Research’s tenth consecutive quarter of revenue growth. The company also highlighted record results for fiscal year 2025. Annual revenue reached $20.6 billion. This was a 27% year-over-year increase. Furthermore, FY2025 saw record gross and operating margins. Diluted non-GAAP EPS for the full year was $4.89.

Stronger Future Guidance

Lam Research provided an optimistic outlook for the third quarter of fiscal year 2026. The company forecasts revenue between $5.4 billion and $6.0 billion. This guidance exceeds prior market expectations of roughly $5.33 billion. Earnings per share are projected to be between $1.25 and $1.45. This is higher than the market consensus of $1.20. Therefore, the company expects continued momentum. This guidance suggests sustained demand for its technology.

AI Drives Semiconductor Demand

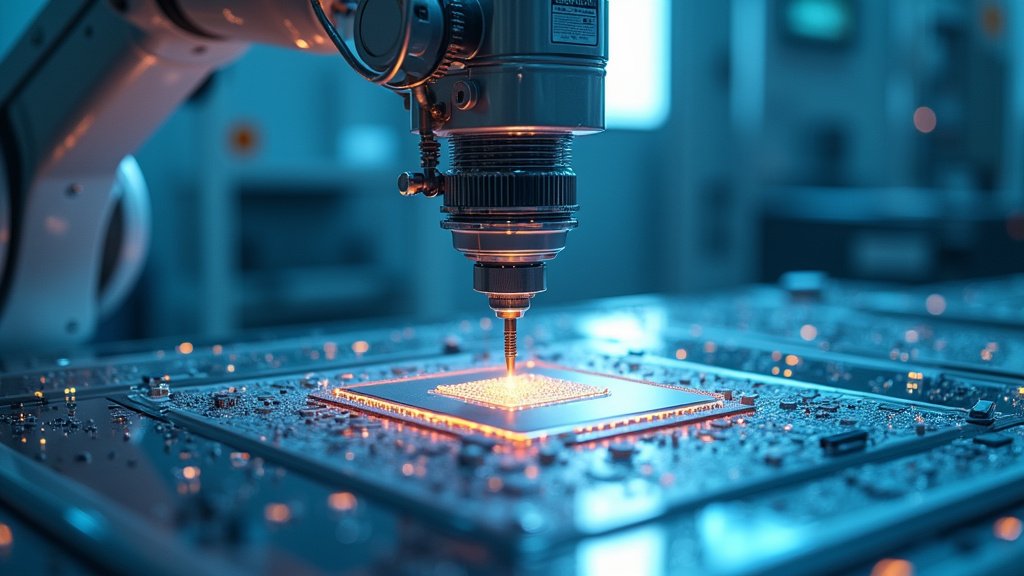

Artificial intelligence is a primary driver of this strong performance. The demand for higher chip performance is accelerating. This fuels increased investment in wafer fabrication equipment. Chipmakers are ramping up spending. They aim to support AI-related workloads. Consequently, demand for sophisticated tools used in advanced semiconductor manufacturing is high. Lam Research’s deposition and etch technologies are essential for these chips.

The overall wafer fabrication equipment (WFE) market is projected for significant growth. It is expected to reach $135 billion in 2026. This is up from an estimated $110 billion in 2025. Advanced packaging is also a key growth area. Lam Research expects it to grow over 40% in 2026. This technology news is critical for future electronics.

Market Context and Constraints

Lam Research holds a significant market share in the WFE sector. Its products are crucial for advanced logic and memory devices. However, industry growth faces constraints. Shortages of available clean room space are a major factor. Because of this, growth is expected to be weighted towards the second half of 2026.

Despite these challenges, Lam Research remains confident. CEO Tim Archer stated the “AI transformation is driving industry spending higher”. The company is focused on expanding its market share. It also prioritizes profitability objectives. Furthermore, its expanding product portfolio supports the market’s transition to smaller, complex devices.

Investor Reaction and Future Outlook

Following the earnings announcement, Lam Research’s stock showed positive movement. Analyst firms have responded with price target increases. Evercore ISI raised its target to $275. RBC Capital also increased its target to $290. This indicates strong investor sentiment. The company’s consistent performance and clear strategy position it well. It is poised to benefit from the ongoing acceleration in wafer fabrication equipment spending through 2027. This trending technology news highlights Lam Research’s vital role.